04:07:37 pm 08/20/2023

Viewed: 5374

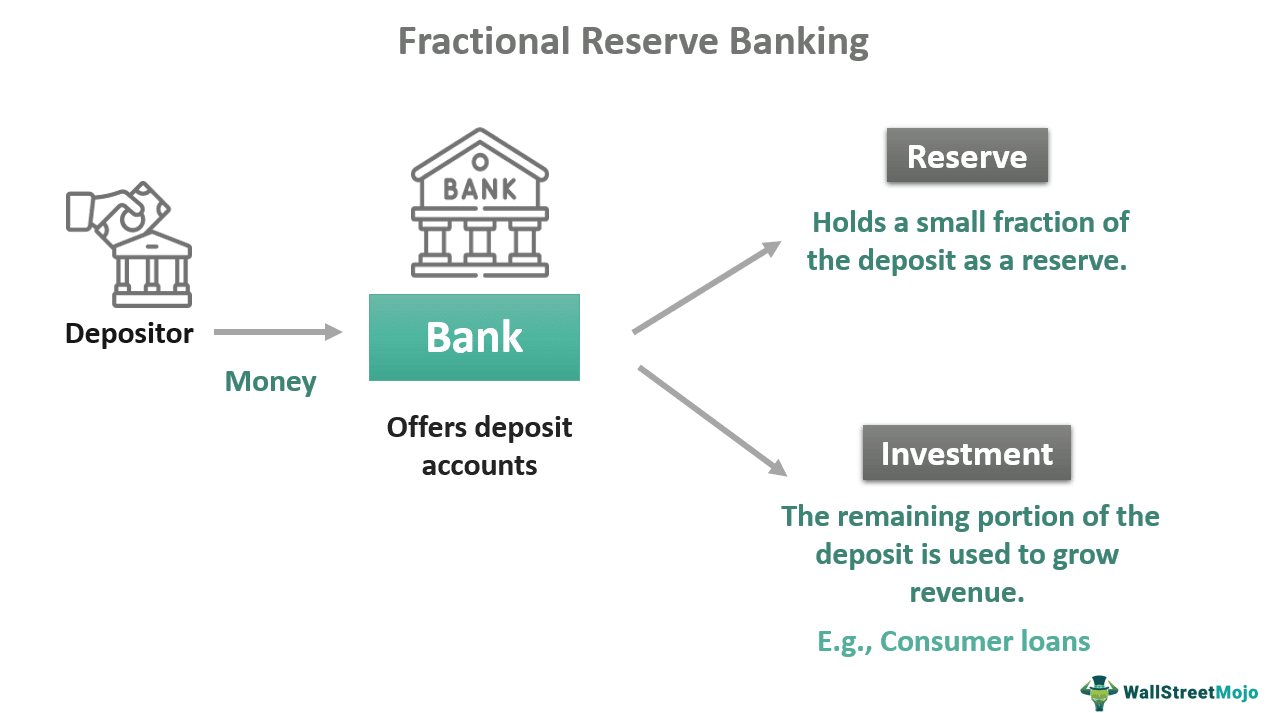

Fractional reserve banking is a system in which banks are required to hold only a fraction of their deposit liabilities in reserve, with the rest being available for lending or investment. Here's how it works and who it benefits:

How It Works:

Deposits and Reserves: When customers deposit money into a bank, the bank is required to keep a fraction of that money in reserve. This reserve requirement is typically set by the central bank or other regulatory authorities.

Lending and Investment: The remaining portion of the deposits (i.e., the fraction not held in reserve) can be lent out to other customers or invested in various financial instruments. This is how banks make money, by charging interest on loans and earning returns on investments.

Money Creation: As the bank lends out money, it essentially creates new money in the economy. The borrower spends the money, and it eventually gets deposited back into the banking system, where the process repeats. This leads to a multiplication of money in the economy, known as the money multiplier effect.

Liquidity and Risk: Banks must balance the need to provide liquidity (i.e., cash on demand) to depositors with the desire to make profitable loans and investments. If too many depositors demand their money at once, a bank run can occur, leading to potential insolvency. This risk is mitigated through central bank support and deposit insurance schemes.

Who Benefits:

Banks: Banks profit from the interest and returns on loans and investments made with the money that's not held in reserve.

Borrowers: Individuals and businesses benefit from access to credit, which can be used for consumption, investment, or expansion.

Economy: By facilitating lending and investment, fractional reserve banking supports economic growth and development. It helps in the efficient allocation of capital and resources.

Depositors: While the primary benefit goes to the banks and borrowers, depositors also gain some interest on their deposits, although typically at a lower rate than what the bank earns on its loans.

Criticisms:

Some critics argue that fractional reserve banking can lead to financial instability, especially if banks take on excessive risk in their lending and investment practices. The system's reliance on confidence means that panic (such as a bank run) can have severe consequences. Additionally, the money creation aspect can lead to inflationary pressures if not properly managed.

Summary:

Fractional reserve banking is a complex system that plays a central role in modern economies. It benefits various stakeholders, including banks, borrowers, and the broader economy, but it also comes with inherent risks and challenges. Proper regulation, oversight, and risk management are essential to maintaining the stability and integrity of this system.

How It Works:

Deposits and Reserves: When customers deposit money into a bank, the bank is required to keep a fraction of that money in reserve. This reserve requirement is typically set by the central bank or other regulatory authorities.

Lending and Investment: The remaining portion of the deposits (i.e., the fraction not held in reserve) can be lent out to other customers or invested in various financial instruments. This is how banks make money, by charging interest on loans and earning returns on investments.

Money Creation: As the bank lends out money, it essentially creates new money in the economy. The borrower spends the money, and it eventually gets deposited back into the banking system, where the process repeats. This leads to a multiplication of money in the economy, known as the money multiplier effect.

Liquidity and Risk: Banks must balance the need to provide liquidity (i.e., cash on demand) to depositors with the desire to make profitable loans and investments. If too many depositors demand their money at once, a bank run can occur, leading to potential insolvency. This risk is mitigated through central bank support and deposit insurance schemes.

Who Benefits:

Banks: Banks profit from the interest and returns on loans and investments made with the money that's not held in reserve.

Borrowers: Individuals and businesses benefit from access to credit, which can be used for consumption, investment, or expansion.

Economy: By facilitating lending and investment, fractional reserve banking supports economic growth and development. It helps in the efficient allocation of capital and resources.

Depositors: While the primary benefit goes to the banks and borrowers, depositors also gain some interest on their deposits, although typically at a lower rate than what the bank earns on its loans.

Criticisms:

Some critics argue that fractional reserve banking can lead to financial instability, especially if banks take on excessive risk in their lending and investment practices. The system's reliance on confidence means that panic (such as a bank run) can have severe consequences. Additionally, the money creation aspect can lead to inflationary pressures if not properly managed.

Summary:

Fractional reserve banking is a complex system that plays a central role in modern economies. It benefits various stakeholders, including banks, borrowers, and the broader economy, but it also comes with inherent risks and challenges. Proper regulation, oversight, and risk management are essential to maintaining the stability and integrity of this system.

No video exists.

Comments

mitch