10:36:52 am 12/18/2023

Viewed: 6723

The Resurgence of US Shale: A Challenge to OPEC's Dominance

In the ever-evolving landscape of global oil markets, a dramatic shift has occurred, reminiscent of a phoenix rising from the ashes. The US shale industry, once perceived as a fading force, has made a formidable comeback, challenging the long-standing dominance of the Organization of Petroleum Exporting Countries (OPEC).

The Unexpected Rise of US Shale Production

A year ago, US government forecasters had a modest outlook for domestic oil production, estimating an average of 12.5 million barrels per day in the current quarter. However, recent adjustments have skyrocketed this figure to 13.3 million barrels daily. This increase is not just a number; it's akin to adding a new Venezuela to the global oil supply.

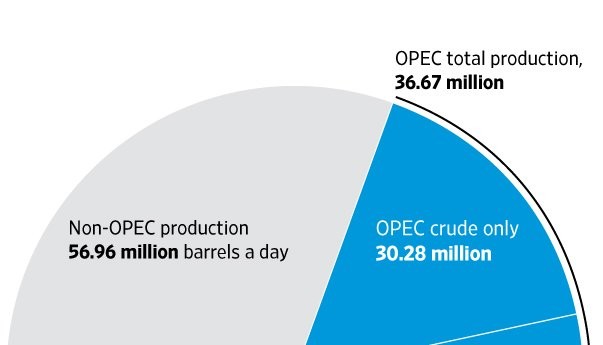

This resurgence is sending ripples across the globe, raising questions about the effectiveness of OPEC+'s strategy to curb supplies and stabilize prices. US shale fields, driven by a multitude of companies, have demonstrated their capacity to disrupt OPEC's plans significantly.

OPEC's Struggle Against Shale

OPEC, along with its Russian ally, has long sought to counter the influence of North American shale. Their strategy dates back to 2014 when they flooded the market with crude to regain market share from the burgeoning US oil sector. This move led to a drastic 65% drop in crude prices, severely impacting the economics of US shale.

However, the shale industry, after a brief setback during the global pandemic, emerged with a renewed focus on financial prudence over production expansion. This shift in strategy has allowed them to gradually increase output, much to OPEC's chagrin.

The Current State of Oil Markets

Despite OPEC+'s efforts to enforce supply quotas and balance the market, their recent production cuts have not prevented further declines in crude prices. The US shale industry, along with rising production in Brazil and Guyana, continues to grow, potentially necessitating further action from OPEC+.

Interestingly, this increase in US crude production comes amid a 20% reduction in drilling rigs. This paradox is a testament to the industry's efficiency improvements, ranging from advanced electric-pump technology to innovative fracking techniques.

The Future of Oil Production

The US shale industry's ability to increase output with fewer rigs is a significant development. Companies like Diamondback Energy Inc. have drastically reduced drilling times, showcasing remarkable efficiency gains. This trend is echoed in the fracking process, where the duration has been shortened, reducing costs and increasing output.

The consolidation of companies in the shale industry has also played a crucial role. Larger entities with greater resources have been able to drive further efficiencies, setting a new standard in oil production.

Conclusion

The resurgence of US shale presents a complex challenge for OPEC and its allies. As the US continues to enhance its production capabilities, the global oil market dynamics are poised for significant changes. This situation underscores the ever-changing nature of the energy sector, where today's underdog can become tomorrow's leader.

In the ever-evolving landscape of global oil markets, a dramatic shift has occurred, reminiscent of a phoenix rising from the ashes. The US shale industry, once perceived as a fading force, has made a formidable comeback, challenging the long-standing dominance of the Organization of Petroleum Exporting Countries (OPEC).

The Unexpected Rise of US Shale Production

A year ago, US government forecasters had a modest outlook for domestic oil production, estimating an average of 12.5 million barrels per day in the current quarter. However, recent adjustments have skyrocketed this figure to 13.3 million barrels daily. This increase is not just a number; it's akin to adding a new Venezuela to the global oil supply.

This resurgence is sending ripples across the globe, raising questions about the effectiveness of OPEC+'s strategy to curb supplies and stabilize prices. US shale fields, driven by a multitude of companies, have demonstrated their capacity to disrupt OPEC's plans significantly.

OPEC's Struggle Against Shale

OPEC, along with its Russian ally, has long sought to counter the influence of North American shale. Their strategy dates back to 2014 when they flooded the market with crude to regain market share from the burgeoning US oil sector. This move led to a drastic 65% drop in crude prices, severely impacting the economics of US shale.

However, the shale industry, after a brief setback during the global pandemic, emerged with a renewed focus on financial prudence over production expansion. This shift in strategy has allowed them to gradually increase output, much to OPEC's chagrin.

The Current State of Oil Markets

Despite OPEC+'s efforts to enforce supply quotas and balance the market, their recent production cuts have not prevented further declines in crude prices. The US shale industry, along with rising production in Brazil and Guyana, continues to grow, potentially necessitating further action from OPEC+.

Interestingly, this increase in US crude production comes amid a 20% reduction in drilling rigs. This paradox is a testament to the industry's efficiency improvements, ranging from advanced electric-pump technology to innovative fracking techniques.

The Future of Oil Production

The US shale industry's ability to increase output with fewer rigs is a significant development. Companies like Diamondback Energy Inc. have drastically reduced drilling times, showcasing remarkable efficiency gains. This trend is echoed in the fracking process, where the duration has been shortened, reducing costs and increasing output.

The consolidation of companies in the shale industry has also played a crucial role. Larger entities with greater resources have been able to drive further efficiencies, setting a new standard in oil production.

Conclusion

The resurgence of US shale presents a complex challenge for OPEC and its allies. As the US continues to enhance its production capabilities, the global oil market dynamics are poised for significant changes. This situation underscores the ever-changing nature of the energy sector, where today's underdog can become tomorrow's leader.

No video exists.

Comments